Have not been posting here for some time, keeping busy with projects elsewhere, so a few pieces to catch up on. First up, something for the South China Morning Post from all the way back in February looking at when Iranian President Raisi visited Beijing. As it turned out, a prelude to the Chinese supported Iran-Saudi deal.

Power imbalance in China-Iran relations on full display during Raisi’s Beijing trip

Sanctioned and isolated, Tehran has less to offer Beijing than Moscow, which can at least boast a powerful military and global presenceWithin Iran, there is also wariness of Chinese investment, and not even shared concerns about Afghanistan have helped to spur cooperation

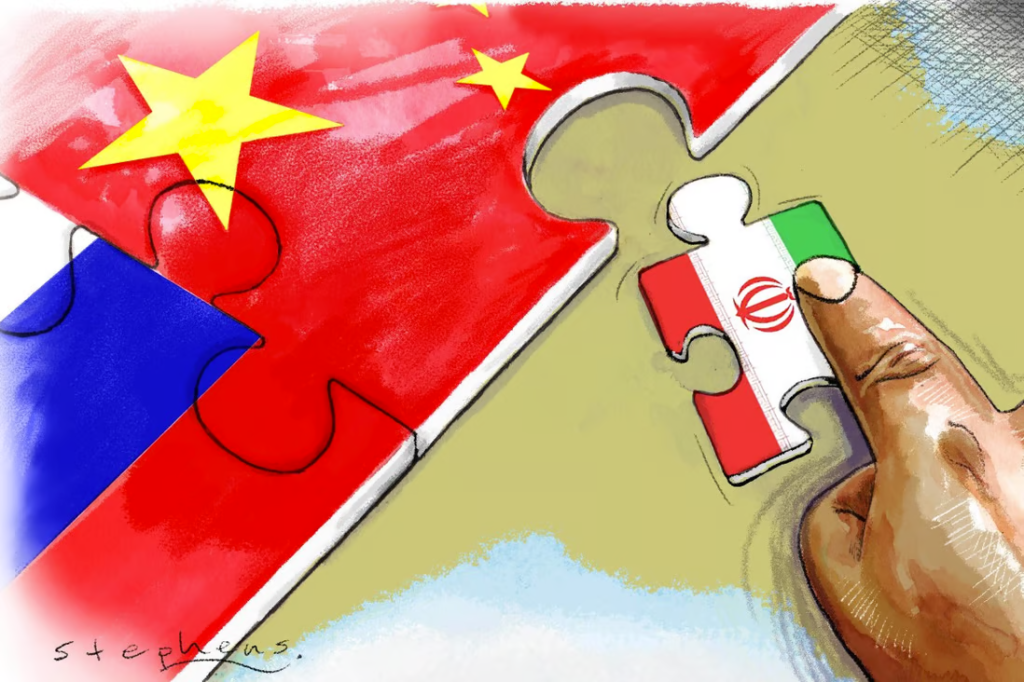

There is a third leg in the alliance of powers against which the West is facing off that has always seemed a little wobblier than the other two. The China-Russia relationship is as tight as ever, and the Russia-Iran link is only hardening as Tehran steps up its military support to Moscow.

The China-Iran link, however, seems more troubled. Last week’s visit by Iranian President Ebrahim Raisi to Beijing has been sold as an opportunity to bolster cooperation, but even with a high-profile boost, it is unlikely to come anywhere close to the strength of the other two.

China needs Iran even less than it needs Russia. Moscow is, in fact, an important partner for Beijing. Putting to one side the complicated and often contradictory economic relationship, which is clearly shifting ever more firmly in China’s favour, Russia is a United Nations Security Council member and a nuclear power whose army is able to increasingly command global presence.

It may have made a major strategic blunder in its invasion of Ukraine, but it remains a significant player on the world stage and serves an important role for Beijing.

In contrast, Iran is a heavily sanctioned and isolated power that produces little that Beijing immediately needs. Its rich hydrocarbon supplies are of interest to China, as is its large consumer population and open market for outside infrastructure investors. But these are all things that China can also find elsewhere.

Iran does not sit at the heart of any international structures that are useful to China’s efforts to blunt the growing push by the West to isolate Beijing on the world stage. In fact, Iran is desperately keen to join Chinese structures – like the Shanghai Cooperation Organization (SCO) – to demonstrate that it still has important allies.

Nowhere has this relatively limited dependence been on greater display than after President Xi Jinping visited the China-Gulf Cooperation Council (GCC) summit in Riyadh late last year. A joint communique issued after the summit highlighted GCC members’ concerns about Iranian behaviour in shared waters.

The statement generated public rebukes of China by Tehran. At the same time, these were very carefully delivered by the Iranian government as the country still wants to develop a better relationship with China.

The much-vaunted 25-year strategic cooperation deal valued in the hundreds of billions that was signed between the two countries in 2021 was meant to lead to huge levels of investment, and while it has led to some reported projects, it is moving slowly. China continues to import Iranian oil – and not much else – though often reportedly routing the oil via United Arab Emirates or Malaysia to mask its origin.

Chinese firms are still hesitant to operate in Iran due to a fear of secondary sanctions. At the time of the visit, the Iranian press was reporting that Iranian companies had restarted work on the Yadavaran oilfield which had initially been awarded to Sinopec but which they had suspended work on six years ago.

There is considerable resistance to China on the ground in Iran as well. In the wake of the announcement of the 25-year strategic partnership deal, a version of the document was leaked online, leading to a number of senior figures speaking out against it.

Former president Mahmoud Ahmedinejad, previously an eager ally of China’s when in power, expressed concern as part of his lobbying to return to power, recognising the public sentiment against the deal, while other senior leaders highlighted the plight of Uygurs as something the authorities should focus on with China.

Even more recently, a prominent Iranian think tank close to the government published a report which outlined concerns about Chinese “debt trap” diplomacy, drawing on studies of Chinese-supported projects in other locations coming to conclusions which it specifically linked to potential projects signed under the 25-year deal.

Iran also fits awkwardly into a number of other Chinese relationships on the world stage. Xi’s visit to Riyadh was part of a much larger effort by Beijing in the Middle East, and part of a strong push by Saudi Arabia to expand its influence around Asia. Similarly, Israel is an important partner for Beijing – though one whose loyalties to Washington complicate things.

Both Israel and Saudi Arabia are implacable adversaries of Iran, and locked into confrontation with it in various locations around the world. Israel, in particular, has shown itself capable of reaching deep into Iran to go after specific individuals or targets.

Finally, there is the reality of Afghanistan, a country that physically separates China from Iran and is currently governed by the relatively unstable Taliban authorities. While the two countries have engaged on the topic and share very similar concerns, there is little evidence of cooperation between the two.

In fact, the Taliban is often keen to highlight Iranian firms as alternatives to Chinese ones in their pursuit of external investment in the country. In other words, the one place where Chinese and Iranian direct interests collide, the two are in competition.

The reality is that the China-Iran relationship is as unbalanced as the China-Russia one, though the dependency from Iran’s direction is far more substantial. Moscow is as needy of Beijing, but in many ways has more cards that are useful to China. This power dynamic was on prominent display during this week’s visit, which was high on rhetoric with the substance still to be delivered.

Raffaello Pantucci is a senior associate fellow at the Royal United Services Institute (RUSI) in London and a senior fellow at the S. Rajaratnam School of International Studies (RSIS) in Singapore